Introduction to Savvy DeFi

What is Savvy DeFi?

Savvy DeFi is a decentralized credit protocol on Arbitrum that grants borrowers access to an immediate advance on the future yield of their collateral in the form of Savvy synthetic tokens (svTokens).

Savvy protocol allows borrowers to maintain exposure to their choice collateral while gaining access to immediate liquidity with 0% interest, no monthly payments and no risk of liquidation.

Why Savvy DeFi?

Using their existing collateral, Savvy DeFi allows users to continue their investment strategies and get immediate liquidity that can be used for swaps, DeFi activities, or anything else, without the risk of liquidation.

How does Savvy DeFi work?

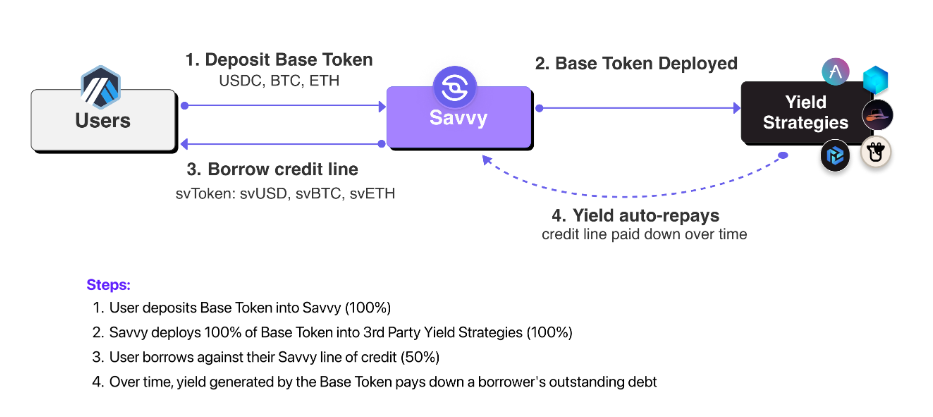

Savvy protocol operates by allowing users to deposit eligible base tokens that are correlated to USD, ETH, or BTC. In return, users can borrow svTokens in the same unit of account, such as svUSD, svETH, or svBTC. Borrowers can repay their debt 1:1 with their original collateral or the svTokens, eliminating the need for liquidations.

These svTokens can be utilized in various DeFi applications or swapped for base assets. Savvy protocol harvests and auto-compounds the generated yield and attributes it to the user's outstanding balance, effectively creating interest-free, auto-repaying credit lines.

How do I interact with Savvy protocol?

In order to interact with Savvy protocol, you simply deposit your preferred base asset and amount. After depositing, you can take out an auto-repaying line of credit. Your deposit will keep earning yield based on the chosen strategy and pay down any debts.

What is the cost of interacting with Savvy protocol?

Interacting with the Savvy protocol requires transactions and cost transaction fees which depend on the network status and transaction complexity. Luckily, transaction fees for the Arbitrum Blockchain are a fraction of their cost on Ethereum Blockchain, making Savvy Protocol accessible to nearly everyone.

What are the risks involved while interacting with Savvy DeFi?

Although Savvy DeFi takes all reasonable precautions both within our protocol and available strategies, no platform can be considered entirely risk-free. The risks related to Savvy DeFi are the Collateral Loss Risk, Collateral Depeg Risk, svToken Depeg Risk and the Protocol Risk. You can find in-depth explanation of these risks and Savvy DeFi Risk Framework in their respective pages under the Risks section of this document base.

SVY Token

SVY is the governance and utility token of the Savvy protocol. SVY token earns veSVY at a linear rate when staked. veSVY is used to vote and decide on the outcome of Savvy Improvement Proposals (SIPs). In addition, a user's veSVY balance is a primary factor in calculating rewards from the Savvy Booster, a reserved allocation of SVY that promotes healthy protocol use, allowing faster repayments of credit lines by generating claimable extra SVY to borrowers.

Detailed documentation on Tokenomics and Governance are available in their respective sections under this document base.

Glossary

If you are unsure about any specific terms feel free to check the Glossary.

Mobile app

Savvy DeFi doesn’t have any downloadable mobile application available. If you find one, it is a scam. Savvy would not ask for your seed passphrase ever.

Savvy DeFi never advertises on any social media or search engine. If you see any advertisement, those are scams and phishing sites. Always check that you are using one of the official social channels, Savvy DeFi does not have any communication channels other than the ones listed under the Additional Resources section of this page.

Last updated