SVY and Tokenomics

Overview

Savvy protocol tokenomics are primarily designed to incentivize long-term protocol health and growth, with a hard cap of 10,000,000 SVY in supply and an emission schedule of 6 years.

The tokenomics approach centers around staking of the SVY token, an ERC20 standard token, to accrue veSVY, a non-transferable vote-escrow token, in an exponential rate. veSVY controls the protocol's governance and gives access to Savvy products such as the Booster and boosted yields.

Further direct utility for SVY tokens are in development to complement the veSVY model and will be revealed after sufficient platform stability.

SVY distribution and emissions

Below is a quick breakdown of SVY distribution and emissions. For a more in-depth breakdown of emission schedule, find our research report here.

Liquidity Provider Incentives

To ensure deep liquidity for liquidity pools on the Savvy protocol, 3,900,000 SVY (39.0%) are allocated to incentivize liquidity providers. These SVY emissions occur on a monthly basis and are subject to DAO governance. In the near future, veSVY holders will be able to vote on how to allocate emissions to liquidity pools using a gauge voting mechanism.

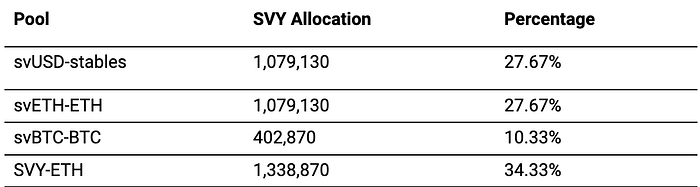

Emissions are planned as follows:

The weights and parameters of the emissions are decided in two week epochs and the current epoch numbers can be found under Savvy Market Making Campaign.

Savvy Booster

To encourage protocol utilization, 700,000 SVY (7%) are allocated to Savvy Booster.

Savvy Treasury

To pay for operations, invest in yield strategies and execute buy-backs from the open market an initial amount of 1,100,000 SVY (11%) is allocated to the Treasury. In addition to this allocation, the protocol fee (10% of generated yield) also goes back into the Treasury, making sure the protocol is constantly well funded to perpetuate healthy operation.

Savvy DAO

To build a healthy Decentralized Autonomous Organization, 1,500,000 SVY (15%) is allocated to Savvy DAO. The Funds are in the DAO can only be deployed based on accepted governance proposals and cannot be disbursed without a valid governance vote.

This allocation can be used for forward marketing efforts, growth opportunities and partnerships. For the Savvy DAO to be able to sign off on a disbursement, SIPs need to include the exact amounts and planned use of the funds.

Ecosystem

To grow the ecosystem by the way of project grants, incentivize users building on top of Savvy and ecosystem co-incentives, 700,000 SVY (7%) is allocated to the Ecosystem Pool. The pool is currently controlled by the Savvy Treasury but will gradually be handed over to the Savvy DAO.

Team

To build and incentivize a dedicated team, 1,100,000 SVY (11%) is allocated that will vest linearly over a 6-year schedule to ensure long-term commitment of each member.

Liquidity Bootstrapping Event

To create the initial Savvy community, initiate the products such as the Savvy Booster and to jumpstart the Savvy DAO, 500,000 SVY (5%) has been emitted for the Liquidity Bootstrapping Event conducted on Fjord Foundry between August 8th and August 11th.

You can access the concluded LBP page here.

Seed Supply

To create long-term institutional stakeholders in the ecosystem, 500,000 SVY (5%) has been allocated as seed supply. Current participation in seed supply is 166,666 SVY (1.66%) of this allocation will unlock linearly over 24 months starting from June 2023. The remaining 333,333 SVY (3.3%) is held by the Savvy protocol until the future partners fitting the right profile has been found.

Last updated